While travel can be an adventure, it can also be very costly. Travel expenses, if tax deductible, can make all the difference for professionals and business owners. This article delves into the intricacies of tax deductions for travel expenses, assisting you in maximizing your savings while ensuring compliance with tax codes.

What Are Tax-Deductible Travel Expenses?

Travel expenses are the expenses you incur when you travel for business purposes. For expenses to be tax deductible, they must meet certain criteria defined by a taxing authority, such as the IRS in the United States.

Tax-Deductible Travel Expenses You Should Know

- Transportation: Airfare, train fare, rental car fees, and mileage for personal vehicles used for business.

- Accommodation: Accommodation costs such as hotels etc.

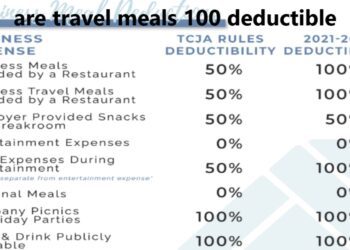

- Meals: Business meals are generally deductible, but only at 50% of their cost.

- Communication: This includes costs for phone, internet and other communication that the business needs.

- Miscellaneous: Laundry and dry cleaning, and tips relating to the trip.

Essential Guidelines to Know for Deductibility

It was announced that travel expenses could be tax deductible:

- Business Purpose: The main reason for the trip must be business.

- Receipts: You need to keep the receipts and record the expenses.

- Reasonable: Expenses should be reasonable and not luxurious.

If part of an otherwise business trip is personal, only the business portion is deductible.

How to Record a Travel Expense

Good records are necessary for claiming tax deductions. Here’s what you need:

- Receipts: Make sure you keep all your receipts for transportation, lodging, and meals.

- Logs: Track all business meetings, date, time, purpose.

- Mileage: If you drive your own car, keep a record of how many miles you drove for work.

- Itinerary: An itinerary detailing the business purpose of your trip can help substantiate your travel.

Self-Employed Goes, Special Considerations

Details For Self Employed Travel Deductions Self employed persons tend to generally have greater freedom in claiming travel deductions. If you are attending a conference, meeting up with a client, or even looking for opportunity and doing research, just make sure that your travel expenses correlate to your job.

Remote Workers’ Travel Can Be Tax-Deductible

If you’re a remote worker, travel between your home and a client’s location might be deductible — but commuting to a regular workplace is not.

Can you deduct international travel expenses from your taxes?

You can deduct international travel costs if the trip is mainly business-related. Of course, if most of the trip involves personal activities, the deductions may be prorated.

Common Mistakes to Avoid

- Mixing Personal and Business Travel: Keep personal and business expenses distinct.

- Poor Documentation: Insufficient documentation can result in denied deductions.

- Assuming Tax Laws Are Universal: Tax laws differ by country and region, so always consult a tax professional.

Conclusion

Many professionals and businessowners benefit financially by understanding if their travel expenses are tax deductible. Keeping up-to-date and accurate records will allow you stay compliant and get the most from your deductions!

Of course, for personalized advice, always reach out to a tax professional who can advise you based on your individual circumstances.