Unlike leisure trips, business clients cannot afford to let time and cost slip, as tax-deductibility is the name of the game. A frequently asked question is whether all travel meals are now 100 percent deductible. Meals can represent a big portion of the cost of a trip, but the IRS has firm rules about how much can be deducted. Here’s a guide to the rules, exceptions and best practices for claiming deductions for such travel meals.

A Beginner’s Guide to Travel Meal Deductions

Travel meals are meals you buy while on the road traveling for business away from your regular place of work. This includes:

- Meals eaten while traveling for business

- Food at conventions or trade shows.

- Food and drink while meeting with clients or colleagues on business trips.

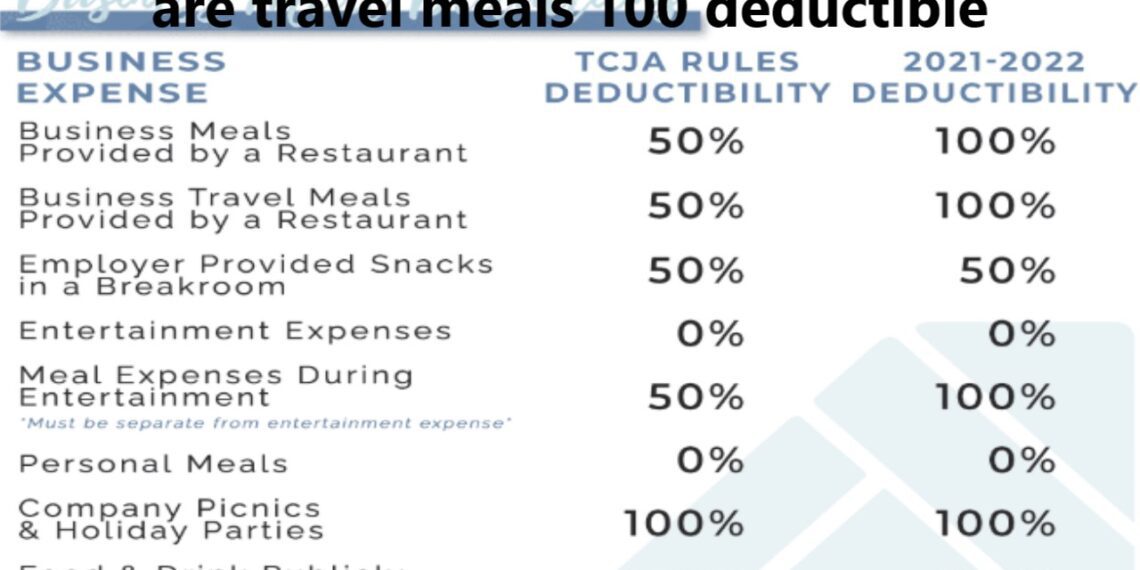

Typically, only 50% of meal expenses are deductible under IRS guidelines. While this is the general premise for deductions, certain meals may be eligible for a 100% deduction.

When are travel meals 100% deductible?

Travel Meals That Really Can Be 100% Deductible There are very specific scenarios where travel meals can be deducted 100%, such as:

1. Company-wide events/ or Gatherings

Meals served to employees during business events among the entire company, such as training events or staff retreats, could also be fully deductible.

2. On-site meals for employee convenience

If meals are provided on the business premises of the employer for the convenience of the employer, the meal may be 100% deductible.

3. Events are held for promotional or marketing purposes

If you have meals associated with promotional events for clients or customers, those may be 100% deductible.

4. Temporary IRS Adjustments

The IRS sometimes offers temporary relief as it relates to business deductions. For example, the IRS permitted 100% deductibility of meals from restaurants for 2021-2022, as pandemic relief for the foodservice industry.

Rules and Documentation Requirements

You must keep proper documentation to claim deductions for travel meals. Here’s what you need:

- Details: Make sure to have detailed itemized receipts for your meal costs.

- Comment on the Business Purpose: Perhaps attending a conference or a meeting with a client.

- Location and Date — Make a record of where and when the expense was incurred.

- Attendance: Who attended the meal (name and position) especially with clients and business partners.

Claiming the Travel Meal Deductions: Best Practices

1. Use a Business Credit Card

A dedicated business card makes tracking, and organizing expenses simpler by having all your meals charged to one place.

2. Know IRS Per Diem Rates

For ease of recordkeeping, the IRS also offers standard daily rates for these two areas as well: meals and incidental expenses (for meals, hotel, etc.).

3. Consult a Tax Professional

Tax law is fairly complex and subject to change. A tax advisor can see to it that you take every legal deduction while remaining compliant.

Common Mistakes to Avoid

- Personal Meals: You may not deduct meals that occur during personal time on a business trip.

- Inadequate Records: Failing to provide receipts or proper documentation can lead to disallowed deductions.

- Getting IRS Rules Wrong: Thinking that all meals are 100 percent deductible could put you on the audit list.

Conclusion

Business travel meal costs are a big part of travel costs and they are not always 100% deductible. Knowing the rules and exceptions from the IRS can help you take advantage of your deductions while still being compliant. All these practices will ensure good tax filings if properly documented.

If you are uncertain about your individual situation, it’s always a good idea to consult a tax professional.